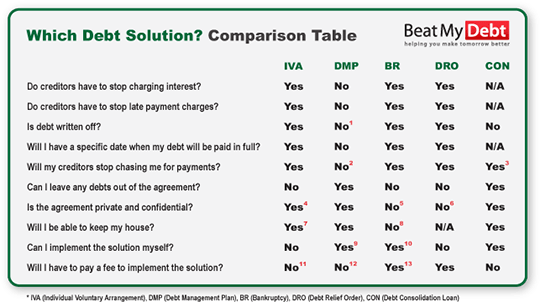

Trying to decide which debt solution is right for you can be daunting and confusing. Use following Table to compare the different options available in England and Wales.

To compare which debts can be included in each solution see the list below.

Comparison Table Notes

1 – If you use a Debt Management Plan it is possible to settle debt with a lump sum payment. As a result some of your debt can be written off. However this does not happen automatically as part of the solution.

2 – If you maintain the agreed payments in your Debt Management Plan it is likely that your creditors will stop chasing you for payment. However this is not guaranteed.

3 – When you use a consolidation loan your creditors will not chase you for payment. However you must maintain the agreed minimum monthly loan repayment.

4 – An IVA is not advertised publicly. However a record of every person who undertakes this type of solution is made in the Insolvency Register which is publicly accessible via the internet.

5 – Since April 2009 Bankruptcy in England & Wales is not advertised in the local newspaper. However a record of the bankruptcy is made in the Insolvency Register which is publicly accessible via the internet.

6 – As with both the IVA and Bankruptcy solutions a Debt Relief Order is recorded in the Insolvency Register which is publicly accessible via the internet.

7 – If you carry out an IVA and are a home owner you keep control of your home. You will not be forced to sell it. However if there is equity in the property you may have to try and release this during the Arrangement.

8 – Your home is not automatically sold if you go Bankrupt. If you buy back the beneficial interest from the Official Receiver you can keep your property. This may cost as little as £1000 if you have no equity.

9 – There is no reason why you cannot negotiate a Debt Management Plan yourself. However if you want help a debt management provider will normally be able to do it for you for free.

10 – You can declare yourself bankrupt yourself if you want. However the application process can be daunting. You must also make sure you are fully prepared for your interview with the Official Receiver. If you would like help and support please consider our Bankruptcy Assistance Service.

11 – There are fees associated with an IVA. However these are taken directly from the monthly payments you make. As such you should not have to pay anything over and above the monthly payments you make to implement an IVA.

12 – If you implement a Debt Management Plan yourself it will cost nothing other than your time. There are also organisations which provide debt management services for free. If you use a commercial debt management company you must expect to be charged for this service.

13 – Before you can submit your Bankruptcy application you will have to pay a fee. There is no way to reduce this. However there are various options you could consider for getting the money together.

Compare which debts can be included in each Debt Solution

To help you compare the debt solutions and decide which is the most suitable for you the list below gives a summary of which debts can be included in each.

| Debt Type | DMP | IVA | BR |

| Credit Cards | Yes | Yes | Yes |

| Personal Loans | Yes | Yes | Yes |

| Catalogue Debts | Yes | Yes | Yes |

| Store Cards | Yes | Yes | Yes |

| Bank Overdrafts | Yes | Yes | Yes |

| Payday Loans | Yes | Yes | Yes |

| Door Step Loans | Yes | Yes | Yes |

| Mortgage Shortfall / Negative Equity | Yes | Yes | Yes |

| Vehicle HP Shortfall Debt | Yes | Yes | Yes |

| Personal Liability for Business Debts | Yes | Yes | Yes |

| Personal Liability for HMRC Debts (Tax/VAT) | No | Yes | Yes |

| Utility Bill Arrears | Yes | Yes | Yes |

| Council Tax Arrears (not current financial year) | Yes | Yes | Yes |

| Student Loans | No | No | No |

| Child Support Agency (CSA) Arrears | No | No | No |

| Court Fines & Penalties | No | No | No |

| Car HP Agreement | No | No | No |

| Mortgage Debt | No | No | No |

| Secured Loan Debt | No | No | No |

Arrange a call with a Debt Management Expert

Privacy Policy

Your information will be held in strictest confidence and used to contact you by our internal team only. We will never share your details with any third party without your permission.